- Análisis

- Análisis Técnico

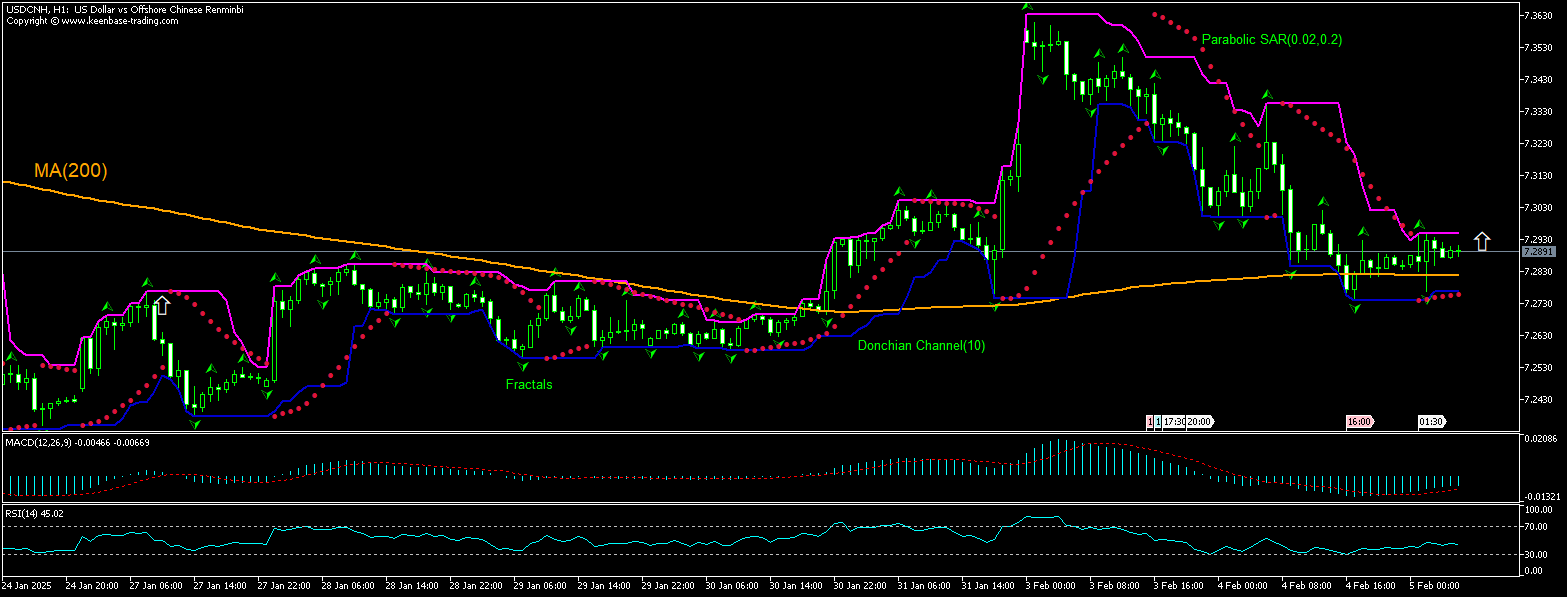

USD/CNH Análisis Técnico - USD/CNH Trading: 2025-02-05

USD/CNH Resumen de análisis técnico

Por encima de 7.29470

Buy Stop

Por debajo de 7.27680

Stop Loss

| Indicador | Señal |

| RSI | Neutral |

| MACD | Comprar |

| Donchian Channel | Neutral |

| MA(200) | Comprar |

| Fractals | Comprar |

| Parabolic SAR | Comprar |

USD/CNH Análisis gráfico

USD/CNH Análisis técnico

El análisis técnico del precio del USDCNH en el gráfico de 1 hora muestra que USDCNH,H1 está retrocediendo por encima de la media móvil de 200 periodos MA(200) después de múltiples pruebas de MA(200) en las últimas 24 horas. Creemos que el impulso alcista continuará después de que el precio sobrepase el límite superior del canal de Donchian en 7,29470. Un nivel por encima de este se puede utilizar como punto de entrada para colocar una orden pendiente de compra. El stop loss puede situarse por debajo de 7,27680. Después de realizar la orden, el stop loss debe moverse al siguiente indicador fractal bajo, siguiendo las señales parabólicas. De este modo, estamos cambiando la relación beneficio/pérdida esperada por el punto de equilibrio. Si el precio alcanza el nivel de stop loss sin llegar a la orden, recomendamos anular la orden: el mercado ha sufrido cambios internos que no se tuvieron en cuenta.

Análisis fundamental de Forex - USD/CNH

La expansión del sector servicios de China se desaceleró en enero. Persistirá el repunte del precio del USDCNH?

La expansión del sector de servicios de China disminuyó más de lo previsto en enero: el PMI Caixin de servicios generales de China bajó a 51,0 en enero, inferior al máximo de siete meses de diciembre de 52,2, y por debajo de las previsiones del mercado de 52,3. Las lecturas superiores a 50,0 indican expansión del sector, mientras que las inferiores indican contracción. La última lectura indica la menor expansión del sector servicios desde septiembre, ya que el crecimiento de las nuevas empresas se redujo a su nivel más bajo en cuatro meses, el empleo registró la mayor caída desde abril de 2024 y la inflación de los precios de venta se desaceleró. El empleo disminuyó por segundo mes consecutivo debido a las dimisiones y los despidos. La reducción de las actividades del sector de servicios de China indica una desaceleración de la economía china, lo que es bajista para el yuan chino y alcista para el par USDCNH.

Nota:

Este resumen tiene carácter informativo-educativo y se publica de forma gratuita. Todos los datos que contiene este resumen, son obtenidos de fuentes públicas que se consideran más o menos fiables. Además, no hay niguna garantía de que la información sea completa y exacta. En el futuro, los resúmenes no se actualizarán. Toda la información en cada resumen, incluyendo las opiniones, indicadores, gráficos y todo lo demás, se proporciona sólo para la observación y no se considera como un consejo o una recomendación financiera. Todo el texto y cualquier parte suya, así como los gráficos no pueden considerarse como una oferta para realizar alguna transacción con cualquier activo. La compañía IFC Markets y sus empleados en cualquier circunstancia no son responsables de ninguna acción tomada por otra persona durante o después de la observación del resumen.